- #Review banktivity for mac how to

- #Review banktivity for mac upgrade

- #Review banktivity for mac software

Getting serious about your personal finance is our mission here. However, with that said, today’s personal finance tools are all about flexibility, and that’s a pretty big loss for Quicken and Banktivity and a win for Truebill. This isn’t the worst thing in the world, considering a month-long free trial is a pretty long time for you to see if an app is worth it for you or not. But what we don’t like, and this is a flaw that it shares with Quicken, is there is no monthly pricing. One thing we like is that you can switch between plans at any time (and hopefully, you’ll be upgrading thanks to Banktivity improving your finances).

#Review banktivity for mac upgrade

Yet, if you are going to spend on a premium personal finance tool, then you might as well upgrade to silver, so you have access to investment, retirement and other features. The Basic Plan includes everything you need to get started. But that’s really just to entice you to invest in the premium version.

#Review banktivity for mac software

This basic level of the software includes some budgeting tools and a few other features.

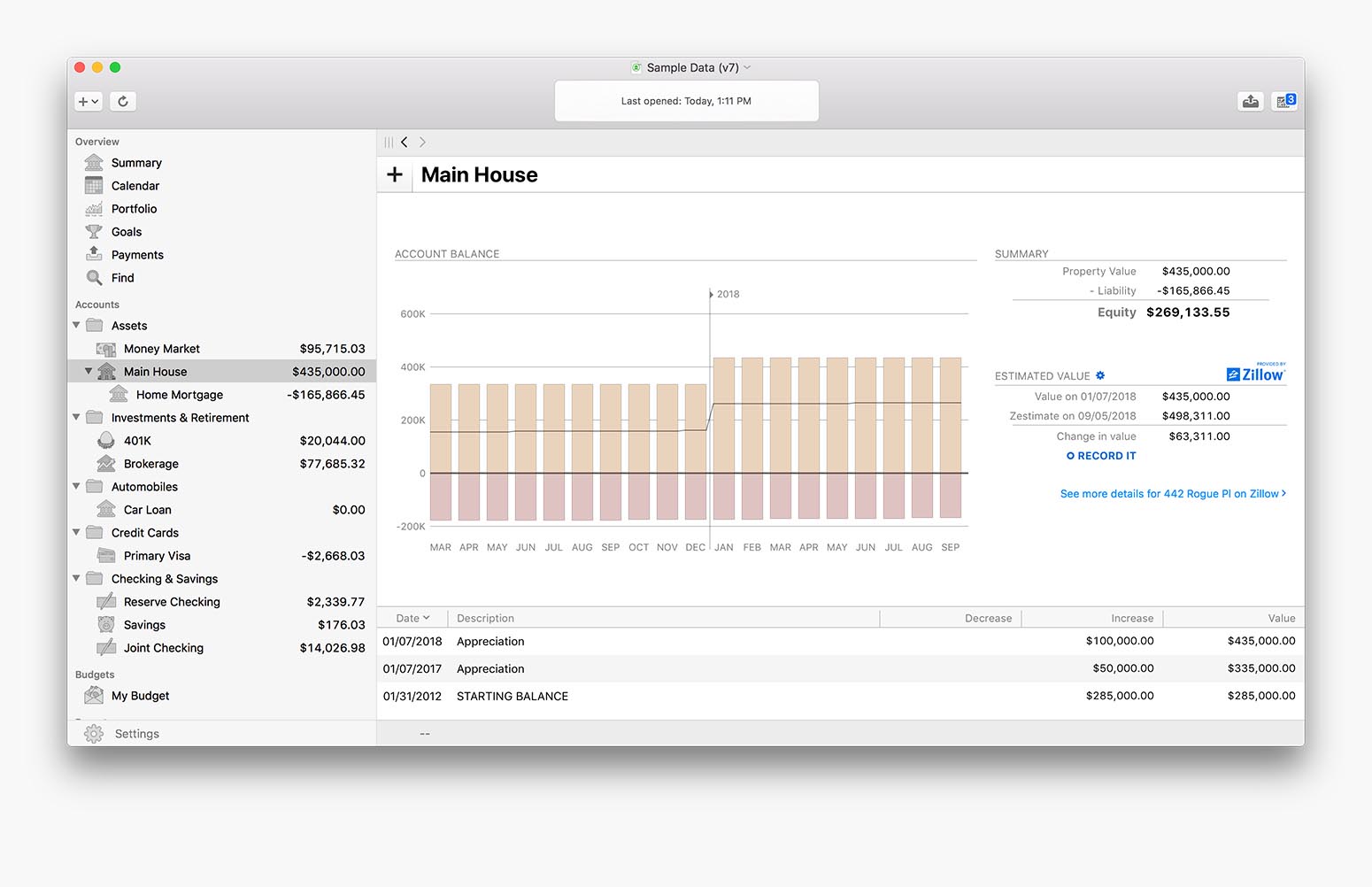

It is to miss that there is actually a free version of Banktivity. What’s cool about it though is that you can work offline by having a desktop app and more robust features set around budgeting, investing, and other financial goals that you find elsewhere. You literally have to download the app onto your computer before you can do anything.įor those of us used to Personal Capital, this will feel a little clunky, but perhaps not having your finances contained with a Chrome window may put your mind at ease that Google won’t have access to every single aspect of your life.Īs with other personal finance apps, you will need to sync your accounts which you do via API (the same as other apps).

#Review banktivity for mac how to

How To Use Banktivityįor millennials and Gen Z, there’s some decidedly retro about the Banktivity desktop experiences. You’ll automatically be downgraded to their basic free plan should you decide not to continue.įinally, Banktivity claims they save their users over $500 and 40 hours spent crunching the numbers, which pays for the $50 premium plan. So, if you’re looking for a new personal finance tool and you’re a Mac lover, it’s well worth giving the free trial a shot. Instead, this really comes to your preference for a user experience.Īnd it is nice having a dedicated option built around macOS that’s secure and feature-rich. But why? With cloud-based alternatives like Hurdlr and Mint out there, why would you ever want to limit yourself to just your Mac?Īnd to be honest, there isn’t a great answer to this, especially since one of the perks of a paid Banktivity subscription is that it syncs your data between iOS and macOS (aka in the cloud) for you. The biggest question you’ll probably have about it is not how to use it, as it’s very user-friendly.

0 kommentar(er)

0 kommentar(er)